24 Apr Workers’ Compensation Average Rate Decrease

A Workers’ Compensation Average Rate Rollback of 12.9% Was Recently Announced. But What Does It Mean for You and Your Business?

HUB breaks it down for you, from the history of rate changes, to the key decision-makers, to the potential impact on your business.

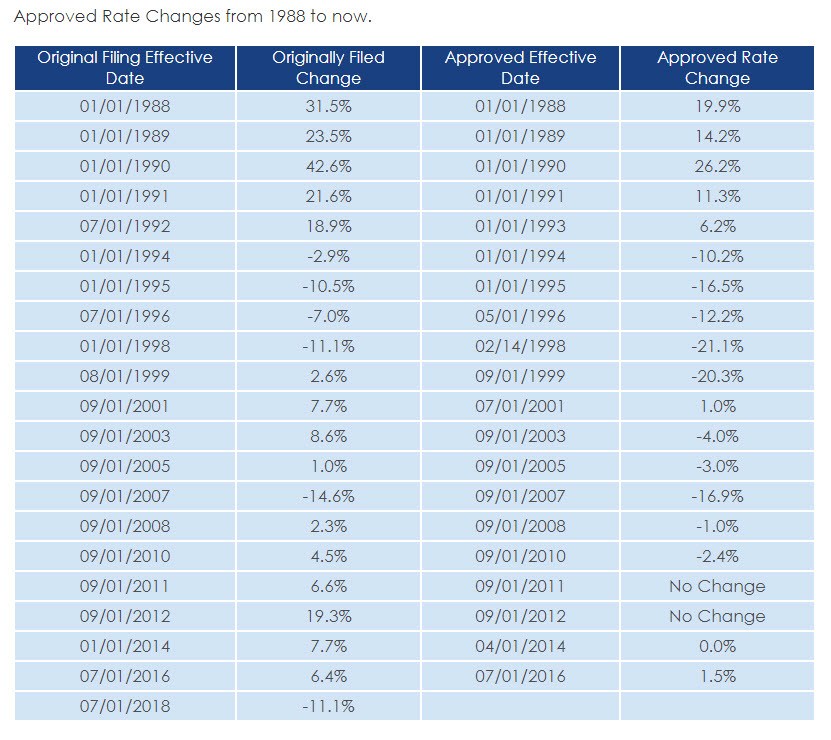

The announcement of a Workers’ Compensation average rate change in Massachusetts is not all that surprising. As you can see from the rate changes chart below, since 1988, there have been 20 workers’ compensation rate changes, ranging from an increase of 26.2% to a decrease of -21.1% for businesses in the Commonwealth.

The announcement of a Workers’ Compensation average rate change in Massachusetts is not all that surprising. As you can see from the rate changes chart below, since 1988, there have been 20 workers’ compensation rate changes, ranging from an increase of 26.2% to a decrease of -21.1% for businesses in the Commonwealth.

And, as you may have already heard, another rate change is coming soon. This time it is a double digit average rate decrease of -12.9% (not yet included on the chart) for all new and renewed policies on or after July 1, 2018, including those in the Massachusetts Workers’ Comp assigned risk pool.

As your local, independent insurance agent, there is virtually nothing more pleasant for us than being able to deliver news of a decrease in insurance premiums to our business insurance clients. However, we want to make sure that you fully understand the details of this statewide average rollback on Massachusetts Workers’ Compensation rates and how it may impact your company’s premiums. Just as Workers’ Compensation Insurance rules and regulations can be complex and unique to each industry and individual business, the news of a rate decrease really is not as straightforward as it sounds.

What is the source of the 2018 average rate decrease?

In the U.S., most states base their workers’ compensation rules, rates and classifications on information and recommendations provided by the National Council on Compensation Insurance (NCCI). But, here in Massachusetts – home to the Boston Tea Party, the Patriots’ Day holiday, and trailblazing healthcare reform – it probably won’t surprise you that we have our own way of doing things!

The WCRIB is an excellent resource for local independent insurance agents such as HUB International, who specialize in Workers’ Compensation Insurance. Through the WCRIB, our team can access the most updated workers’ compensation laws, get information on handling classification and audit issues, and find critical industry manuals, such as the Massachusetts Workers’ Compensation and Employer Liability Insurance Manual.

Most important to businesses like yours, though, is that the WCRIB is the government entity establishing the workers’ compensation rate increases or decreases that can affect what you pay in premiums every year.

Every two years, at minimum, the bureau is required to review and analyze all the workers’ compensation premiums paid by businesses as well as the losses covered by insurance companies across the entire state of Massachusetts. From this in-depth statistical analysis, the WCRIB can calculate workers’ compensation rate and loss averages and, subsequently, estimate how much insurance companies need to take in from premiums to not only insure losses, but also to stay profitable.

Thus, in December 2017, based on their most recent statistical analysis, the WCRIB submitted a rate filing seeking a statewide average decrease in workers’ compensation rates of -11.1 percent that would go into effect as of July 1, 2018. However, after negotiations between a variety of key decision makers, including representatives of the WCRIB, the Attorney General, and the State Rating Bureau in the Division of Insurance (“SRB”), all parties agreed to an even higher discount – an average rate decrease of -12.9 percent.

While there are multiple factors that may have driven this decrease in workers’ compensation average rates this year, some experts have pointed to the fact that there has been a significant increase by businesses statewide to create safer workplaces and focus on other loss control measures. At HUB International, we believe that if more companies make risk management and safety a priority, then there can be a significant impact not only on each individual organization’s premiums and mod rates, but also across an industry, and potentially statewide.

HUB can help you sort through the complex factors that will determine your 2018 Workers’ Compensation rate

The key information in all of the headlines about this workers’ compensation rate decrease is the word “average.” This means that, yes, the median rate decrease will be 12.9%. However, some fortunate businesses will experience an even greater reduction, while other companies’ rates will stay the same or even increase. Because there are so many variables that factor into this rate change, figuring out how it will affect your specific business requires expert assistance from professionals with broad experience working with the Massachusetts Workers’ Compensation Insurance System.

Whether you are a current HUB International insurance client or simply a local business owner looking for information and knowledgeable advice, you are welcome to contact HUB International’s strategic business specialist Ben Garvey, CIC & AAI, Vice President of Risk Management. Ben has worked in the insurance industry for more than two decades and has been a trusted advisor for HUB International’s business clients for over 13 years. He will be glad to not only help you understand how this upcoming workers’ compensation rate change could impact your workers’ comp premium, but also help you:

- Analyze your Workers’ Compensation Experience Modification (Mod) Rating

- Identify, understand and evaluate your business risks and create solutions to control these risks

- Recognize weak safety measures in your organization and business operations that could lead to on-the-job injuries

- Implement or change your workplace safety plans and guidelines in order to reduce your claims and, ultimately, your premiums

- Monitor workers’ comp claims and track them until they are resolved

- And much more

At HUB International, we would like nothing more than to provide you with some good news when you contact us with your questions about the new workers’ compensation average rate and how it will affect your premiums. However, if you happen to be in the pool of businesses whose rates will either stay the same or increase, then we also have the experience to assist you with identifying ways to lower your workers’ compensation rates and mod factors in the future.

If you are ready for a more personal relationship with a trusted insurance agent who is always looking out for you and your business, then call us today at (800) 243-8134 or stop into any one of our three convenient Massachusetts offices.

No Comments